WHAT DO WE SEEK?

Our approach is multidisciplinary, employing a combination of quantitative and qualitative tools, multivariate statistics, applied neuroscience, semiotics and semantics. All the tools may be applied with the following objectives of obtaining market knowledge:

RESPONSES THAT CAN BE TRIGGERED:

We help our clients on their marketing challenges, with executive responses that can be triggered, but with analytic depth.

BUSINESS RESPONSES:

We answer the main business questions of our clients and not only to research briefings.

MARKET OPPORTUNITIES

EXPLORATORY STUDIES

Investigating needs, habits, language and behavior of the consumers; comprehending the process and dynamics of the buying and using of products; distinctive attitude attributes.

HABITS AND ATTITUDES

Getting to know the market, map the brands, raise needs and opportunities (white spaces), aiming the definition of business strategies.

ATTITUDINAL SEGMENTATION

Comprehending the different groups of consumers and their peculiarities, aiming to develop stratified strategies of communication and positioning

CONJOINT ANALYSIS

Which features of the product define the preference of the consumer, to orient the development of new products.

BRAND STRETCH

To survey and evaluate possible ways of line expansion for the brands, aiming at innovation/renovation of portfolio and future development of products and services.

LINE OPTIMIZATION

Seeks for the best combination between products or variants, aiming a bigger coverage of the target public and smaller line complexity.

BRAND ARCHITECTURE AND POSITIONING

EXPLORATORY

Which attributes are relevant and differential to the consumers; which are the unmet needs.

BRAND POSITIONING AND IMAGE

What is the positioning perceived for all the brands of the marked and opportunities of positioning and launching. White spaces.

DRIVERS

Which are the attributes that really make your brand different, as opposed to those that are fundamental, but defining for the category, to define the architecture of the brand.

CONCEPT AND PRODUCT TESTS

Consumers perception of products and concepts

Sensory guiding of consumers preference

Emotional arousal caused by products and fragrances.

Confirmation of sensory claims

BEHAVIORAL SCIENCE & BRAND BUILDING

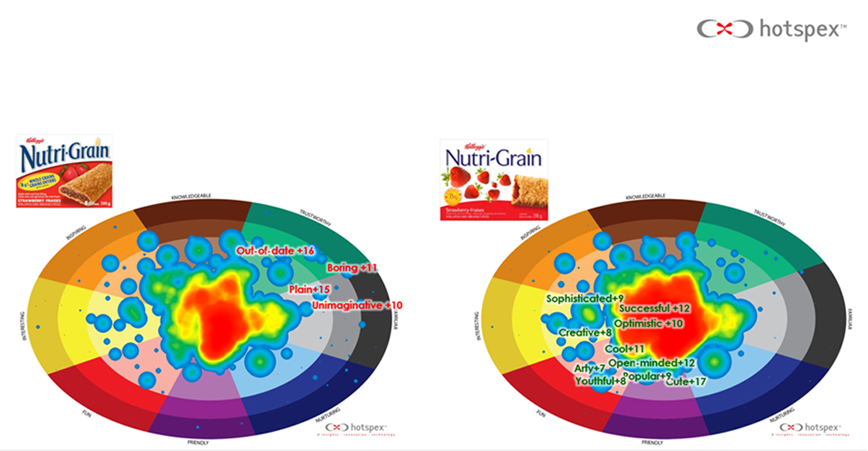

Packspex: package test with realistic display rack and virtual reality.

Perceived Positioning

PRICE AND PERCEIVED VALUE

PRICE

ELASTICITY

For the definition of the price

to be set, aiming to optimize

the choices, with better

results in volume and/or value.

PACKAGE AS A BRAND VEHICLE

DISTINCTIVE ELEMENTS – PRE-DESIGN

What is iconic for the category and the brand and cannot be missing – elements to be kept. Subsides to the design agency.

DESIGN DIAGNOSIS AND SCREENING

Which creative ways fit better with the brand and with the objectives of the redesign and why.

PACKAGE TEST – PACKSPEX

Performance on the shelf (findability, stopping power, sale); diagnosis of elements of design and brand communication.

FUNCTIONALITY

Opportunities of functional improvement.

COMMUNICATION

PRINT MEDIA TEST (ADS, CATALOGS, FOLDERS)

Looking diagnosis and emotions evoked by the material. Capacity of calling the attention, engaging and communication. Diagnosis of the communicational elements.

ADVERTISEMENT TEST

Emotions measured by facial coding and qualitative diagnosis.

SHOPPER AND POS

SHOP ALONG AND MOBILE ETHNOGRAPHY

Investigate in depth the motivations and the shopper behaviors. Gathering subsidies for the decision tree making.

POS

OPTIMIZATION

What is the best disposition to improve visibility, desire and purchase. What are the best materials and dispositions to improve sales.

CONSUMER JOURNEY

From the tree until the moment of closing the purchase.

DECISION TREE

What is the order of decision drivers on the trajectory of the decision of the consumer. What to prioritize in communication and disposal in POS.

CUSTOMER SATISFACTION

Satisfied clients consume more and are more profitable. But how to deal with the available organizational resources, which are limited, to optimize satisfaction? This is the question we propose to answer.

The relationship with the clients is a “vital sign” to any company and may predict a future financial result.

-

- Intensifying Drivers

-

- Generating Satisfaction

-

- Getting Loyal Clients

-

- Generating positive word-of-mouth and rebuy

SATISFACTION AND LOYALTY PROGRAM

1

QUALITATIVE STAGE

SURVEY OF THE DRIVERS Survey of the attributes and detailing of the levels of each attribute. Creation of scales that are tangible, measurable and possible to activate.2

QUALITATIVE STAGE

MEASURING OF IMPORTANCE AND LEVELS OF SATISFACTIONMeasuring the Satisfaction and Loyalty of the clients through a quantitative stage. Tracking the main metrics.

3

MAIN OUTPUTS

- NPS

- Satisfaction and loyalty index

- Influence of the drivers on the satisfaction and loyalty

- Gross negatives

- Client and benchmarks performance

4

MAPPING

OPPORTUNITYGeneration of an action plan through workshop developed exclusively for the client with a specialized team of moderators.

TWO PHASES OF COLLECTION

1st Qualitative Study

p

Through depth interviews, we identify and comprehend deeply what are the attributes most valued on the attention and on the service model. The attributes are employed so that each point of the scale represents and opportunity of improvement on the tangible level of the service, being possible to activate.

2nd Quantitative Study

p

With the attributes of the levels of service defined on the qualitative stage, we prepare the questionnaire in a way that the interviewees may not only evaluate the general satisfaction, but also understand how every service happens on a daily basis.

Evaluation of a client and a benchmark or of a competitor.